This is Not the 1970’s

Written by: Larry Eppolito, CFP®

Greetings!

I last wrote just days before Russia’s invasion of Ukraine. I wrote, “…so, an invasion seems to make little sense. But that may not matter.” As it turned out, it didn’t matter.

The top portion is for those who only want the bottom line. There is more below For Those Who Dare to Venture Forth.

This is one of the hardest letters I’ve ever had to write, but possibly one of the most useful for many. If I have yet to return your call or email over the last several days, I hope you understand. The following represents my beliefs.

Since my last letter, we’ve read about war-related oil and natural gas shortages leading to higher energy prices, war-related food shortages leading to higher food prices, inflation pressures due to covid-related production shutdowns in the face of post-covid-pent-up demand, too much money in our savings accounts, and the Federal Reserve Bank (The Fed) raising short term interest rates in response etc.

Markets are broadly down about 16%, or so, year-to-date as I type. As I’ve written many times, “That’s not down. That’s part of the normal ride.” “Down” is what happens when the economy contracts for a spell during a recession.

There is an awful lot of talk about the potential for an economic recession. And it may come to pass, but this outcome is only one of a number of potential outcomes. This is why the markets have been fairly resilient in the face of such a negative news cycle.

I believe the next 3 to 6 months are going to be rocky.

Inflation Talk is in the News:

- We began to see inflation due to “post-Covid-pent-up-demand.”

- This resulted in a temporary shortage of goods.

- Next, it began to show up in the money supply. Although stimulus payments were clearly needed due to the Covid shutdowns, Congress seemingly went too far. This can be seen in the record amount of savings held by consumers.

- Finally, an inflationary shortage of goods and excess money in the system was exacerbated by a “supply shock” due to Russia’s invasion of Ukraine in February.

- Food and energy prices rose sharply as Russian and Ukrainian exports dried-up.

- The Fed will try to slow the economy to reduce inflationary pressures.

- As I’ve written, money is “fuel for the economic fire.” We have record amounts of money chasing too few goods and services right now.

- The Fed will try to engineer a “soft landing” – i.e. reduce the money supply and increase the cost of money with higher short term interest rates to slow the economy enough to reduce inflationary pressures – without going too far and causing a recession.

- It is currently widely expected The Fed will raise “their” short-term “federal funds” interest rate by 50% (i.e., one half of 1%) in at least each of their next four meetings scheduled for 2022. This is subject to change one way or the other.

- The markets know this and have already adjusted for this expectation! In other words, should the Fed raise their rate 50% at each of the upcoming meetings, it will not surprise the markets.

- Inflation may have Peaked:

- Economic growth has been moderating on its own as we move away from the pandemic.

- This may take some pressure off the Fed.

- There are a number of indicators showing inflation may have peaked as various inflationary pressures have been dissipating – even before Fed rate hikes take effect.

- This may take some pressure off the Fed.

- Economic growth has been moderating on its own as we move away from the pandemic.

This is Not The 1970’s:

- Inflation today is a shorter-term problem, although we likely won’t be seeing 2% inflation for quite a while. There is more on this below (For Those Who Dare to Venture Forth).

Economic Slowdown Talk is in the News

- Recessions come around cyclically, although not like clockwork. They are part of the “ride.” And they’re never any fun.

- As I’ve written, when a client says, for instance, “My account is down 10%,” I’m famous for saying, “That’s not down. That’s part of a normal ride. Down is what happens during an economic recession.”

- The economy was hot in 2021 – with economic output up 7% – versus a 20-year trend of a bit over 2% annually. The Fed wants to slow the economy to reduce inflationary pressures.

- If the Fed slows the economy too much, we may have a recession, but we may not.

- If a recession comes to pass, it could be deep, moderate or shallow. No one knows.

- Recessions tend to drag corporate profits down and the stock market as well.

- During recessions, stocks have fallen from recent highwater marks by an average of about 35%. Sometimes they have fallen more, sometimes less.

- Although past performance cannot guarantee future results, all recessions have come to an end and the economy has proceeded to grow to ever-larger levels – with the stock market generally growing with the economy.

- The Fed may engineer a slowdown without causing a recession – thus creating a “soft landing.” Stay tuned to this station.

- Although we could have a recession over the next year or two, we may not have one for years.

- For perspective: Economists recently polled by Reuters put the odds of a recession at 25% this year and at 40% next year.

- These are averages of the projections of all those polled, but you get the idea. Nothing is certain and no one knows. Projections aren’t guaranteed and are subject to change, as information changes. (1)

Why don’t we step away until the skies clear?

We saw this issue two years ago. During a bull market (an upward trend in prices) there are often many head fakes, during which it looks like the economy may fall into a recession, but it doesn’t. During the last bull market, stocks broadly rose almost exactly 400% from the March 2009 low to the February 2020 cycle peak. There were 7 periods during which stocks fell by 10% or more from the recent highwater marks. Two of the pullbacks were nearly 20%. In each case it looked like it could be the beginning of the next economic downturn, but it was not. Long-term investors with a short-term mindset may have made a mistake had they reacted.

Historically, reacting to the news, or “gut feeling” has often been a costly mistake. For instance, the stock market broadly rose just over 100%, or so, off the March 23, 2020 Covid bottom to the recent highwater marks. I believe a lot of investors sold near that bottom and proceeded miss much of that ride – because bottoms are never obvious. Risk: Getting “priced-out” of the markets may be the most expensive mistake long-term investors can make.

If we have a soft landing, we may be near a market bottom now. If we have a recession, we likely have further to go on the downside. It could be a lot; it could be a little. Although past performance cannot guarantee future results, by the time a recession is obvious to people, much of the market downturn is usually behind us. Why?

Markets Are Forward-Looking

- Markets know everything being put forth in the media and have largely already adjusted.

- Markets adjust for new news, as things change one way or the other. If things get worse than currently expected, markets will move lower. If things get better than expected, markets will adjust higher.

Pre-Planning for the Recessionary Portion of a Market Cycle.

- We deal will market cycles by adjusting our stock to bonds/cash allocation to that which suits us for the longer run.

- By adjusting our stock to bonds/cash allocation, we have pre-planned for the recessionary portion of a market cycle.

The Media Has Been Very Negative Lately.

- When it comes to finance, I believe talking heads reading a teleprompter are less than helpful for long-term decision-making.

- For example, news anchors are programmed to get excited about large Dow Jones Industrial Average (DJIA) daily point movements. As I’ve written, in the 21st Century, it takes a lot of DJIA points to move the market either up or down 1%. Daily DJIA point movements tell us almost nothing about the future.

- …and I believe complicated subjects are boiled down to easy-to-understand sound bites that are often inaccurate.

In summary, I believe:

- The Crux of the Issue: The Fed can cure inflation if it wants to – or if it has The question is, “Does the Fed have to create a recession to do it?”

- The Fed has work to do.

- Economic growth is slowing on its own. This means the Fed may have to do less to cool-off the economy.

- Inflation looks like it may have peaked. If so, the Fed may have to do less to cool-off the economy.

- The Economy Has Been Strong:

- Unemployment is near historically low levels.

- Consumers are largely flush with cash and debt is low.

- Corporate profit growth has been trending positive.

- We are still in the Post-Covid-Pent-up-Demand stage. People are “leaving their shelters” and are traveling and consuming other services.

- Inflation averaged about 2% annually for the last 20 years, or so, up to Covid, due to “Relentless Disinflationary Pressures.”

- Economists whom I read believe inflation will likely average around 2.75%, or so, over the coming economic cycle, as some of the “sticky” inflation remains or dissipates less. Of course, it could be higher or lower.

- Up until about 20 years ago, the long-term average for annual inflation was about 3%. (2)

- Although past performance cannot guarantee future results, stocks have historically beaten bonds and inflation over long periods of time. This is why investors often have a large portion of their assets in stocks.

So, the economy has been strong and may be able to rebound quickly from a slowdown (via a “soft-landing”).

Hindsight Bias

Whatever comes to pass, you’ll think you knew it was going to happen – after the outcome becomes clearer! This is normal human psychology. Most everyone will feel this way no matter the outcome! I believe everyone has hindsight bias – some more than others. Of course, this includes me –but I’ve learned to recognize it over my 38 years.

It’s amazing how many opinions are floating around out there. I believe the negative opinions get the most airtime. That’s ok. I’ll keep writing letters.

Economic concepts can be complicated. The following is for those who want more than I’ve written above. A major take-away is: Lessons we’ve learned in the past are often not applicable today.

Please feel free to call me with any questions.

For Those Who Dare to Venture Forth

First of All…

Stocks were broadly down more than 3% on Thursday May 5th. The media tends to use loaded words to describe a day like that (“plummet is often used for instance). It attracts viewers… Many media outlets did not mention stocks were up the day before by nearly the same amount. The point is, I believe the news plays havoc with our emotions.

Please keep in mind, large daily point movements in the DJIA are rather meaningless. As the years have gone by, it seems to many the markets are more volatile, but they are not! How so?

“1000 Points Aren’t What They Used to Be” or “The Law of Large Numbers”

The day I started in the business, April 9, 1984, the Dow Jones Industrial Average (DJIA) closed at 1243. A 1000-point fall from 1243 to 243 would have required an 80% move in the index! Likewise, a 1,000 point move up or down on a 10,000 DJIA is about 10% while a 1,000 point move on a 30,000 DJIA is ~3.3% etc.

Percentages Give Meaning to Otherwise Meaningless Numbers!

If someone makes 10% on their $100,000, that is $10,000. If their neighbor makes 10% on their $1,000,000, that is $100,000. They both made 10% on their money. I believe most people know this but forget this.

Economic growth is stated in terms of Goss Domestic Product – GDP – essentially, what the US produces in goods and service.

Generally, the size of the stock market is related to the size of the economy. In 1984, the US produced ~$4T in goods and services (GDP). Right now, US GDP is ~$23T. So, we have a DJIA >30,000 in 2022 – not a 1200 DJIA like in 1984. Although past performance cannot guarantee future results, if the economy grows at its long-term average growth rate over the coming decades, the GDP number and DJIA numbers will likely get bigger. If so, a 1,000 DJIA point move, one way or the other, will have an ever-smaller effect on wealth over the years in percentage terms. This is why daily DJIA point movements have gotten bigger over the decades – even though the markets are not necessarily more volatile when viewed in percentage terms. But the news anchors don’t have this on their teleprompters! (3)

I believe long-term investors have a hard time making good decisions by watching the news. Why?

Markets are Forward Looking

As I’ve written, markets move ahead of the news. This means the markets already know about current energy prices, the recent high inflation, future federal funds rate increases by the Fed etc. So, it’s been widely reported the Fed is expected to continue to raise interest rates to counter inflationary pressures. The markets will move due to Fed actions – if the Fed does something different than expected!

If Fed actions slow the economy and reduce inflationary pressures without going too far and creating an economic contraction (i.e., if we have a “soft landing”), stocks may resume their uptrend as they tend to grow with the economy over many years. If the economy contracts (i.e., we have an economic recession), stocks will like move lower.

I’m famous for saying, “Economic recessions come around cyclically. But not like clockwork. Recessions ‘cleanse the economy’ of excesses.” They are healthy. But when recessions come around no one is going to like it. All recessions are scary. They don’t happen for our convenience (i.e., to give us an “opportunity” to invest more money into stocks at lower levels).

Some recessions are deep, long lasting, and painful. Most post WWII have been relatively short, but no-so-sweet (they’re never sweet). The 2020 recession lasted about 2 months. So, in big picture terms, let me offer three potential outcomes. We could have:

- A deep downturn

- A shallow recession

- A Fed-engineered soft-landing, such that the economy doesn’t contract, and stocks resume their upward trend rather quickly.

Of course, there are potentially a number of variations off these three outcomes, but I believe these three well-represent major categories under which many variations can fall.

Question: “Larry, why don’t we seek shelter until the skies clear?”

Answer: Many people do.

Problem: This is a dangerous game.

Studies show most people seeking shelter tend to do it at or near the bottom of the cycle. Why?

It’s because markets move ahead of the news – in a counter-intuitive fashion. How so?

Exhibit 1: Forward Looking Markets

I wrote the following (in italics) on March 27, 2020, as Covid was just getting a major foothold – but had not yet exploded.

Markets Move Ahead of the News

I believe the following is what confounds many investors:

- Although past performance cannot guarantee future results, stocks tend to move ahead of the news. They tend to fall before the bad news peaks and bottom in the midst of the malaise.

- Stocks turn up when you least expect them to do so – when the news is bad and looks like it will get worse.

- After making a final bottom, stocks tend to move up in anticipation of the “coming good weather.” They rise with seemingly no tangible reason as to why they should do so.

- In the early stages of a bull market, stocks rise in the face of bad news, as the news slowly “becomes less bad.”

- By the time investors are comfortable (i.e. “the skies turn blue”), stocks have often been going up for many months – sometimes years.

When I wrote this letter, unemployment was just starting to happen, and experts were talking about hospitals being overwhelmed, but this was largely still in front of us – and coming on fast.

I wrote:

The News Will Likely Get Much Worse Before It Gets Better

As the days and weeks go by, I believe you’ll be hearing a lot about:

- Rising unemployment and slowing economic activity.

- The numbers will likely be eye opening. Again, this is all largely expected, but is just starting to happen now.

- Sharply rising Coronavirus infections.

- The TV news will likely be unnerving to many, but, again, it’s largely expected.

- …and hopefully that’s as close you and your family get to the virus.

The Punch Line

Although things were about to get much worse, the stock market had bottomed four days earlier – on March 23rd! But of course, no one knew that at the time.

In the March 27th letter I’d also written:

- I believe markets have either bottomed, or will eventually make a final bottom in the midst of the malaise.

- As markets tend to move well ahead of the news, after bottoming, markets will move-up in the face of bad news, in anticipation of better days.

- We’ll go through alternating periods of optimism and pessimism.

So, as you can see, although past performance cannot guarantee future results, the markets did indeed move ahead of the news cycle – bottoming before the deluge – not coincident, or after it! This is what confounds people! I wrote similar paragraphs during the 2008 Financial Crisis.

Inflation

A few of my clients like to have discussions with me about inflation. Those clients find the topic interesting – and so do I. It’s a complicated subject and is open to judgment and interpretation. I tend to read a number of different economists and I rarely find them fully agreeing with one another. Maybe that’s what makes the subject so much fun. The following is written in general terms and may help to make you more interesting at your next cocktail party (or maybe not!). Some of this is a bit complicated. Also, there is some redundancy – I left it in on purpose. It’s good stuff for those of you who are interested. I suggest you just skim through any part that’s not working for you.

Inflation Today: (Due to supply-demand imbalances and due to too much money in the system.)

Cyclical (“Transitory”) Inflationary Pressures

Today, food and energy cost have been rising sharply due to a “supply shock.” These price increases have been greatly exacerbated by Russia’s aggression against Ukraine as wheat, corn, fertilizer, natural gas, oil etc. is heavily exported from those countries. Typically, with commodities, prices are cyclical. Generally, when prices rise profits rise, so many commodity producers increase production tend to try to capture the higher prices. Higher production inevitably leads to higher supply and lower prices – and vice versa. Over the coming months and possibly years, the war will be a bit of a wildcard with regard to energy prices in particular (food sources are more easily replaced). If not for the war, we would have expected food and energy to cycle down normally. Regardless, supply chains will adjust, but this may take some time. The Fed’s “monetary policy” cannot fix a supply shock.

Sticky Inflationary Pressures

Some items rise in price and don’t tend to come down as much later-on when inflation cycles back down. Some examples include wages, rent, home prices etc.

Much of our inflation was initially due to supply shortages as the production and distribution of goods was halted intermittently with Covid outbreaks – in the face of rising post-Covid-pent-up demand. It was widely believed these shortages would be “transitory,” as production (supply) caught up with demand – and as the pent-up demand fell back to normal. These inflationary pressures may have largely been transitory, but many economists have argued The Fed may have been a bit slow to act to reign-in inflationary pressures (the debate is beyond the scope of this letter). Also, Russia’s war against Ukraine exacerbated many shortages.

Transition from Goods to Services

During the Covid isolation period, many consumers spent less money on services (such as restaurants, sporting events etc.), and redirected their dollars to goods. Many households were given stimulus checks – even if they were not unemployed. A lot of money was spent on goods today that we were planning on buying down the road, as we suddenly had the time and the money to address the issue today. So, the initial inflation pressures were felt in the goods sector. As we come out of hibernation, consumer demand has been rising in the services sector and will likely slow for goods. As the economy transitions from goods to services, supply and demand imbalances should even out. This will help the Fed in its fight to reign-in inflation.

The Federal Reserve Bank

Although The Fed “printed” the money demanded by Congress (Congress holds the purse strings) it is now the Fed’s job to manage a slowdown that results in a soft landing. This will require:

- Raising the Federal Funds rate (increasing the cost of money) and

- Reducing the money supply via Quantitative Tightening – QT, by selling bonds held on their balance sheet (The mechanics of QT are beyond the scope of this letter).

The Fed will meet five more times this year. The Federal Funds rate, which is the most well-known Fed mechanism for controlling the money supply, is currently targeted to a range of 0.75% to 1.0%. It is largely expected they’ll raise “their” Federal Funds interest rate by 0.50% in the first four meetings and by ¼% in the fifth in December. If so, the Federal Funds target range would be 2.75%-3.00% by the end of the year. Again, this is “baked” into expectations right now. Markets will react one way or the other to any changes in current expectations.

The Fed has other, more complicated, tools at their disposal about which the media rarely writes. They are beyond the scope of this letter. (4)

Monetary Inflation

Monetary inflation is the proverbial “too much money chasing too few goods and services.” Congress dumped a lot of money into the economy to help those who lost their jobs and to help to stimulate the economy due to the Covid shut-downs. This arguably needed to be done. And central banks around the world followed our lead, as directed by their legislative bodies. Many economists believe Congress went too far with the stimulus.

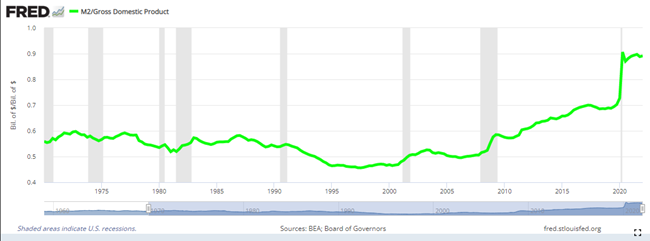

“M2” is a measure of money in the economy. I believe this will be a topic of discussion in the media over the coming months, so it’s time to brush-up for upcoming cocktail parties!

M2 tends to grow as the economy grows. But M2 is at record levels having risen by about 40% (or ~19% annually) during the 24-month period of Covid ending March 2022. For perspective, the pre-Covid annual M2 growth trend was about 6% annually. The Fed will be looking to reign-in some of the excess money. This is what economists are talking about today. (3, 5)

If you look at the chart below, you’ll notice that M2 as a percentage of GDP grew sharply from the Financial Crisis of 2008 to the Covid crisis. But we did not have an inflation problem for this period! This is not what we were taught in the 1970’s! What gives?

M2

Inflation averaged 3% annually from 1926 to about 2008 – the year the economy slipped into the Financial Crisis recession. Since then, inflation has averaged about 2%, or so – about 2/3 of the historical trend.

Question: But Larry, if M2 has been rising so sharply since 2008, why has inflation stayed below the longer-term trend?

GDP growth has been just over 2% since 2008.

As with inflation, this is also about 2/3 of its long-term trend. This is partly due to the following:

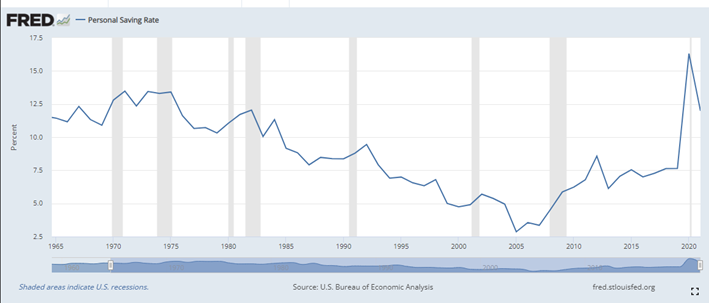

- After falling for about 30 years to a record low of 2% in 2005, consumer Personal Savings Rates began to rise sharply.

- Personal debt as a percentage of disposable income had risen to historical highs in 2005 – as the real estate bubble peaked – just before the Financial Crisis.

- Consumers began to “get their balance sheets in order,” by paying down debt and increasing their savings.

- As savings rates rise, consumption falls. This means people are generally less eager to spend.

- This shows up in falling “money velocity.” (More on this below). (3)

Inflation: This is Not the 1970’s

In the “1970’s,” (actually ~1973-1982) inflation averaged 8.72% annually for the 10-year period ending 1982. There were a number of factors contributing to the inflation problem back then. (6) Generally:

First of all, we had a very strong underlying demand for goods and services largely due to a growing population, the post-WWII economic expansion and other factors. In addition, the US had very high Personal Savings Rates coming into the early 1970’s. Savings rates started to fall as people began to consume more in the 1970’s. Generally, at the time, the global economy was not quite ready to meet the demand. So, we had a bit of a supply-demand imbalance problem, but unlike today, it was more of a chronic problem. Today’s demand is a post-Covid-pent-up demand whereby there was a bubble of demand for goods – in lieu of services – causing sharply rising prices in goods. That bubble of demand for goods is beginning to dissipate as we venture out of our homes and start to consume more services.

I believe the Federal Reserve Bank was one of the most important causes of the inflation of the 1970’s. How so? From 1970 to mid-1979, there were two Fed chairman, Arthur Burns and G. William Miller respectively, both of whom continued to leave open the “monetary spigots” – pumping money into an economy that had already begun to enter a vicious inflationary spiral due to supply-demand imbalances. And they continued to leave the spigots open for much of the decade! Why is beyond the scope of this letter. There have been many case studies written about the 1970’s-era Fed.

Energy Prices Were Only Part of the Problem

Many people thought it was rising energy prices that “created” the inflation back then because that’s the sound bite the newspapers gave us. It was seemingly obvious. But as I’ve written in the past, rising energy prices are a disinflationary pressure! Higher energy prices take money out of the pockets of The People – they have less money to spend elsewhere. Rising energy prices cannot cause broad inflation – unless The People’s consumption of other goods and services is not reduced even in the face of the high energy prices. This requires a hot economy, sharply rising wages – and a Federal Reserve Bank accommodating that hot economy. In this case, energy did contribute to the inflation – largely because of Burns and Miller. …and then along came Fed Chairman Paul Volker with his very high federal funds rates in 1980-1982. The economic fire was out of control, and it took extreme measures to put the fire out. Federal funds peaked at 21% in June 1981. (3)

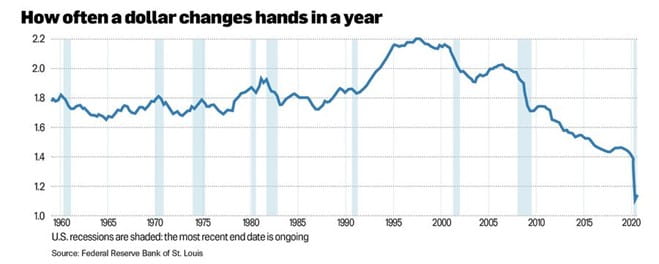

Money Velocity

Basically, velocity tells us about the rate at which a dollar spent in the economy multiplies. For instance:

- In the 1970’s for every extra dollar of M2, there was between 7 and 1.8 dollars of new spending.

- At the beginning of the 2008 Financial Crisis, for every extra dollar of M2 there was about 0 dollars of new spending.

- Velocity proceeded to trend down nearly in a straight line from ~2.0 in 2008 to about 4 by the beginning of 2020 – just before Covid.

- This was in the face of rising M2! (3)

- Velocity proceeded to trend down nearly in a straight line from ~2.0 in 2008 to about 4 by the beginning of 2020 – just before Covid.

Money Velocity

Generally:

- When consumers and businesses are more eager to spend money the velocity of money increases.

- When the economy is growing relatively slowly, or contracting, consumers and businesses are usually more reluctant to spend, and the velocity of money is lower.

- As you can see above, money velocity had been trending lower since the Financial Crisis of 2008.

Generally:

- If the money supply is relatively high and velocity is high, this can be inflationary. This was largely true in the 1970’s./li>

- If the money supply is relatively high, but velocity is low, a large money supply may not be inflationary.

- Velocity is hard to predict.

Personal Savings Rose Sharply After Bottoming in 2005

Higher personal savings rates generally mean consumers were less eager to spend. So:

- The Fed increased the money supply in an attempt to stimulate the economy as it was chronically operating at a below average level.

- The US, along with many other industrialized nations around the world, were increasing the money supply to avoid deflation.

- US interest rates were near 0% during portions of the cycle and a number of foreign countries were fighting deflation with negative interest rates!

- Personal savings rates are hard to predict.

Relentless Disinflationary Forces: Becoming Less Relentless, But Have Not Gone Away

Generally, inflation peaked about 40 years ago. Inflation averaged less on an annual basis over the last 20 years than it had annually in the previous 75 years, or so. Why? (3)

Up until recently, I believe inflation had been struggling to gain traction despite years of “central bank accommodation” (as measured by growth in M2) and a recovery in economic growth since the end of the Financial Crisis of 2008. This has largely been true around the world. Why?

I believe there are a number of “Relentless Disinflationary Forces” at work. Although past performance cannot guarantee future results, these forces generally include:

- Aging population: Demographic changes mean lower consumption from aging baby boomers (consumers tend to begin to spend less starting in our 50’s).

- Savings rates: In recent years, there’s been a generational change to higher savings rates. Ignoring 2020 (a huge year for savings), savings had risen to around 8% of disposable income from a 2% bottom in 2005. (This exerts a downward pressure on money velocity*).

- Deleveraging: After decades are rising levels of personal debt, individuals have been largely reducing debt. Since less demand for debt means consumers are less eager to spend, debt is no longer acting as a tailwind (as during the build-up years), but as a headwind to economic growth. (This exerts a downward pressure on money velocity*).

- A flat yield curve: Short-term rates have not been very far below longer-term interest rates, due to central bank “accommodation” (Quantitative Easing – QE, during which the Fed buys bonds onto their balance sheet) and low inflation. This generally works against the banking system, which borrows short and lends long. This helps to constrain lending. (This exerts a downward pressure on money velocity*).

- Wage growth has been moderated:

- Due to global competition.

- Wages have also been held down by the aging of Baby Boomers. Lower paid millennials are replacing higher paid retirees often for much lower wages.

- Retail Prices: Global competition has been putting downward pressure on prices in retail (China and other emerging markets).

- Internet sales are helping to keep a lid on retail prices.

- Manufacturing costs have been falling thanks to robotics, 3-D Printing etc.

- Artificial Intelligence (AI) helps to improve productivity, thus helping to hold down costs.

- US energy technology: Although prices have recently traded to the high side due to the post Covid spike in demand and the war in Ukraine, advances in drilling technology and a move to alternative energy sources had been keeping energy prices relatively low.

- The velocity of money* has been well below the historical averages (1960 to 2022, St. Louis Federal Reserve Bank).

Any of the above forces are subject to change. For instance:

- Globalization has been a major disinflationary force for decades. I believe:

- On-shoring of domestic production will increase,

- Off-shoring of production to far-away countries with lower costs of production will decrease,

- Globalization will be replaced with “regionalization,” such that goods outsourced to other countries will be manufactured closer to home by our “friends” (regionally).

- This will reduce our supply-line risks but will put less downward pressure on prices leaving consumers with a bit less money to spend elsewhere.

M2 Summary:

For the time period between the Financial Crisis of 2008 and the onset of Covid:

- M2 has risen at an above average rate, but

- Inflation rose at ~2% versus a ~3% trend line.

- GDP rose at ~2% versus a ~3% trend line.

- Money velocity trended down as personal savings rates rose.

- There have been a number of relentless disinflationary pressures around the globe.

- The Punchline: So, rising M2 did not help to create above average levels of inflation as it did in the 1970’s.

Current Inflation Expectations

Many forward-looking indicators are telling us that inflation may have peaked and is starting to come down. (7)

A recent poll of economists at large financial institutions shows expectations of inflation dropping from around 6.5% in Q1 2022 to under 5% by year end. Inflation is expected to drop to the low 3% area by the end of 2023. This is the “mean,” or the average of the expectations of the economists polled. Some polled expect higher inflation, some expect lower than the average inflation. Of course, these are expectations and are subject to change, but they are based on what we know today. (1)

Economic Growth (as measured by Gross Domestic Product – GDP)

GDP is a complicated measure of economic output. For instance, when we import more than we export, it lowers the GDP number. So, what good is it? It’s used by economists and the government to understand the economy. Professionals tend to look at the trend, or the rate of change, in particular. After a seemingly weak Q1 2022 (due to strong US demand for imported goods and a working-off of high inventories in some sectors – see it’s complicated), the average expectation of the economists polled shows a slightly above-average growth rate for the rest of the year and average to slightly below average growth in 2023, as post-Covid-pent-up demand dissipates.

Of course, this is an average of analyst expectations. The range includes some economists who are looking for a recession and some who are looking for economic growth to accelerate to above-average levels. (1)

Many economists believe a lot of the demand for goods has been front-loaded – i.e., some of what we would have bought in 2023 and 2024, we bought today. Again, as pent-up demand is sated, inflationary pressures may dissipate. If so, this may make it easier for the Fed to engineer a soft landing, but they have their work cut out for them.

In summary, I believe:

- Although no one knows, I believe this year will be rather volatile mainly due to the Fed looking to keep inflation under control.

- Inflation probably isn’t going back to 2% (the recent 20-year average annual tend) anytime soon, but that’s all right as long as it is somewhat moderate.

- Post-Covid-pent-up demand for goods initially created inflation in the goods

- Inflation for many goods has been falling as demand for services has been rising.

- Russia’s war of aggression has created a supply shock in the volatile food and energy sectors.

- Economic growth has been strong but is moderating as we move away from the pandemic.

- The money supply (M2) is at historically high levels. (3)

- The Fed will attempt to raise the cost of money and reduce the money supply in an effort to tame inflation.

- The Fed will try to engineer a soft landing.

- If we fall into recession, the slowdown could be shallow, moderate, or deep.

- Economists recently polled by Reuters put the odds of a recession at 25% this year and at 40% next year. Projections are subject to change at any time. (1)

- Markets have largely discounted Fed actions. The bond market is expecting four rate hikes of 0.50% in each of the next four Fed meetings and 0.25% in December.

- Economists recently polled by Reuters expect 5% inflation by year-end and dropping towards 3% in 2023. Expectations are subject to change at any time. (1)

- Economists recently polled by Reuters expect GDP to drop-off to just above the 10-year average in the mid-2% area in 2022 and towards 2.0%, or so, in 2023. This represents an average of those polled, the range of opinions is quite wide, and expectations are subject to change at any time. (1)

- Markets are forward-looking and will move based on new

- We still have Relentless Disinflationary Forces as we’ve had for the last 40 years, or so, although some, such as Globalism, are becoming less relentless.

- This is not like the 1970’s.

- Lessons we’ve learned in the past are often not applicable today! Sometimes history repeats, sometimes it rhymes, sometimes it doesn’t rhyme.

- Since stocks are forward-looking and move in a counter-intuitive fashion, individuals who try to “dance around” market cycles often have poor results over time.

- We pre-plan for economic downturns with our stock to bond allocation.

- Although past performance cannot guarantee future results, stocks have historically beaten bonds and inflation over long periods of time.

My glass remains “half full.”

Stay safe and please feel free to call me with any questions.

Best!

Larry

5/12/22

P.S. Please feel free to send this along to those who may benefit. As you’ve probably noticed, we don’t generally ask clients for referrals, as I don’t wish to obligate anyone. At the same time, given all of the turmoil in the world, there are a number of things that concern me and I fear many people are in need of guidance. If there is anyone you care about who could use a second set of eyes, we’d be happy to meet with them to try and help them out. If so, please let me know.

Important Disclosures

Eppolito Financial Strategies, LLC. is not a registered broker/dealer, and is independent of Raymond James Financial Services. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. Eppolito Financial Strategies is not a registered broker/dealer and is independent of Raymond James Financial Services.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Sources:

- Reuters Poll, April, 2022

- Longer Runway for Growth and Inflation, Joe Zidle, Blackstone, 5/12/22

- St. Louis Federal Reserve Bank (FRED)

- Bond market futures price-in expected future Fed changes to Federal Funds.

- Eyes on the Fed, Brian Wesbury, First Trust, 11/8/2021

- USinflationcalculator.com

- Institutional Equity Strategy, Raymond James, May 8, 2022

Other Sources:

- CNBC

- Financial Advisor Magazine

- Wall Street Journal

- The Wall Street Journal

- New York Times

- The Boston Globe

- Raymond James Institutional Equity Strategy

- Colliding Demand and Supply Shocks, Franklin Templeton, May 2022

Important Disclosures

Any opinions are those of Larry Eppolito and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change. This information is not intended as a solicitation or recommendation of any kind. Investments mentioned may not be suitable for all investors. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Diversification and asset allocation do not ensure a profit or protect against a loss.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Stocks offer long-term growth potential but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations and the potential loss of principal.

Investing in fixed income securities (bonds) involves certain risks such as market risk, if sold prior to maturity, and credit risk, especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond prices fluctuate inversely to changes in interest rates. In other words, if interest rates rise, after your purchase, you may receive less than your purchase price should you liquidate early. Bonds provide a fixed rate of return if held to maturity.

Other Important disclosures

Securities offered through Raymond James Financial Services, Inc., member FINRA / SIPC. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. Eppolito Financial Strategies is not a registered broker/dealer and is independent of Raymond James Financial Services.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by e-mail, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. E-mail sent through the Internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all e-mail.

Any information provided in this e-mail has been prepared from sources believed to be reliable but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in e-mail. This e-mail is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.