A Case for Improving the ROI of a Financial Wellness Program

By: Michael Carbone, CFA, CFP®

HR professionals have widely acknowledged the strong relationship between workforce productivity and financial wellness. Why? Because employees experiencing greater financial stress are more likely to be physically and mentally absent and seek other employment.

There have been sophisticated studies conducted that attempt to measure the potential benefits of an investment in employee financial wellness – some citing returns on investment (ROI) of up to three times in terms of cost savings per employee1. Although the findings of these studies may be predicated on imperfect data, it’s easy to conclude that a less financially stressed workforce is likely to be more productive (and happier) for employers versus a workforce that’s more financially stressed.

So, if it’s reasonable to assume that the return component of the ROI equation is generally positive, the only thing left to solve for is whether the potential return is incremental to the cost of acquiring it i.e., the implementation costs of a financial wellness program.

The implementation costs of a financial wellness program vary – and may be potentially difficult to interpret at times. For example, your company’s 401k provider may offer a complimentary financial wellness program as an ancillary benefit. Although this may be an attractive benefit, it’s important to understand the potential tradeoffs – do free lunches exist?

I believe that most financial wellness initiatives have the potential to create value for organizations; however, I believe that HR professionals may also benefit from exploring partnerships with local financial advisors. Why? because the right advisor may offer more effective education, at a lower cost. How?

Local professionals have experience advising ordinary people which, in practice, is more sophisticated than textbook advice. This different perspective may translate to a deeper understanding of how ordinary people think and feel about their money, etc. and potentially lead to more effective workshops.

Local professionals are incentivized to do a good job. Professionals seeking to grow their reputation in the community are greatly incentivized to get in front of people. Delivering workshops to an organization’s employees can be a great opportunity for local professionals to build their brand – I believe many advisors would offer this service for free.

- In addition to the opportunity for the advisor to grow their brand - if the professional delivers effective education, attendees may ask for a 1-on-1 consultation, which may result in an opportunity for the advisor to sign up new long-term clients.

I believe that in order for this type of partnership to be successful, the advisor must agree to offer the educational workshops for free and commit to a no-sales approach, agreeing to not solicit business from or discuss products for sale in the educational workshop setting.

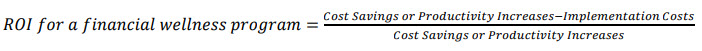

The return on investment for a company's financial wellness program can be measured as:

So, if there is a high likelihood that an organization would benefit from an improvement in the overall financial wellness of their workforce, and the costs of partnering with a local professional may be significantly lower than alternative solutions, I believe it may behoove HR professionals to explore these partnerships further.

HR professionals may wonder, what’s the risk? The main risk with this approach is the potential for the local professional to go against their word of delivering a no-sales approach. In this scenario, the workshop attendees may feel uncomfortable, and potentially lose trust in the employer. Although I believe this risk is low if the HR professional thoroughly vets the professional, it’s a risk, nevertheless. How can HR professionals reduce this risk? They may explore partnership with the Association of Financial Educators (AFE). I’m currently an AFE member.

AFE is a nationwide 501(c)(3) nonprofit educational bureau seeking to educate individuals and communities with the knowledge they need to take control of their own financial wellbeing. The benefit to partnering with a local professional and an organization like AFE is that the professional is contractually obligated to not discuss product-specific information during employee educational workshops.

Please let me know if you have any questions or would like to learn about the programs I’ve written to help companies improve the overall financial wellness of their staff. Thank you for reading!

Michael Carbone

1https://retirementincomejournal.com/article/the-elusive-roi-of-financial-wellness-efforts/

Eppolito Financial Strategies, LLC. is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice.