Dividend Growth vs. High Dividends vs. Buying the Market: Which Strategy has Historically Earned the Highest Returns for its Risk?

By: Michael Carbone, CFA, CFP®

There are generally two ways you can make money in stocks:

- Capital gains i.e., a rising stock price, and

- Dividend income

The sum of these is referred to as the investment’s total return. For example, if an investor sells a stock for 5% higher than what they purchased it for and received a dividend worth 2% of the stock’s price while holding it, their total return would be 5%+2%=7%.

The relationship between dividends and capital gains can be tricky. On one hand, investors may view dividend paying stocks as being healthy, stable, capable companies – which may lead to stronger capital gains. On the other hand, dividends are typically paid to shareholders out of company earnings. This in turn reduces the amount of cash that’s available for the company to invest towards future growth and may result in lower capital gains.

Needless to say, the question of whether to favor a dividend strategy can be complicated.

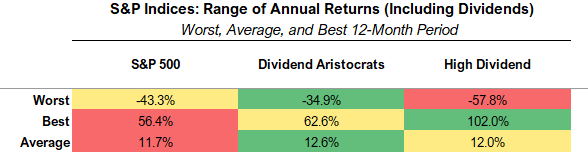

To assess this for yourself, I believe it can be helpful to consider the potential risk vs. reward for different types of stocks – specifically as it relates to their dividend. Consider the last three decades of historical returns for these three popular market indices:

- The S&P 500 Index1

- The S&P 500 Dividend Aristocrats Index2, and

- The S&P 500 High Dividend Index3

Source: LSEG Workspace

So, how have these indices historically performed?

- Although past performance doesn’t guarantee future results, over the long-run, the Dividend Aristocrats Index has earned the highest average 12-month returns while also experiencing significantly less downside volatility during extreme periods.

- The High Dividend Index has historically offered the most extreme returns with the highest and the lowest 12-month returns. Much of this can be explained by the returns that occurred during the ’08 financial crisis.

- The S&P 500 had more severe drawdowns vs. the dividend aristocrats but less so than the high dividend stocks – the average 12-month return for the S&P 500 was slightly lower than the other two indices. This may be largely due its relative performance surrounding the dot-com bubble of the 2000’s.

The limitation of analyzing this historical return data is that we’re looking to the past, which is by no means guaranteed to repeat itself. That being said, we can draw meaningful conclusions about how dividends can affect the risk and return potential of an investment:

- For starters, higher dividends aren’t always indicative of higher returns. In fact, history shows that a higher dividend yield may even indicate greater risk as investors may be less willing to pay up for the stock. This may lead to greater volatility during periods of market/economic stress.

- History also suggests that investors may gravitate towards dividend growth portfolios during periods of market stress.

- The potential risk reward characteristics of dividend growth strategies may suit them well for retirees who are living off their money.

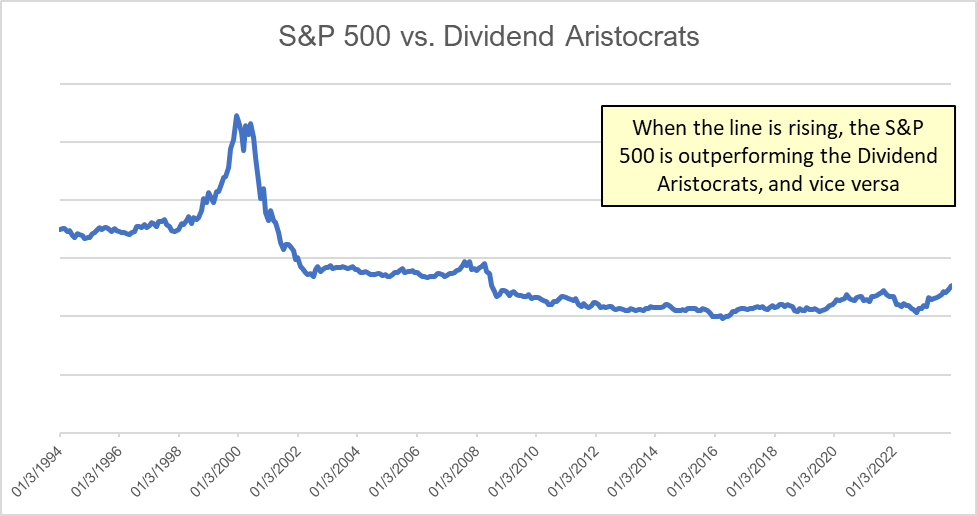

Another drawback to analyzing historical return data is that “studying it” and “living it” aren’t the same. For example, it’s easy to say, “the companies in the S&P 500 have generated lower average returns vs. dividend paying companies over the last three decades - so, I’m just going to buy dividend growth stocks and call it a day.” When the reality is that certain investments can outperform for many years and there’s no way to know if “something is different this time”. Consider the following chart which represents the relative performance of the S&P 500 vs. the Dividend Aristocrats over the 30-year period. There were several multi-year periods where either index outperformed the other.

Source: LSEG Workspace

In summary:

- There are pros and cons to focusing on dividends when investing in stocks.

- Historically, companies with a strong track-record of increasing their dividend have gone down by less during outlier downturns. Alternatively, these types of stocks have historically gone up by less during strong bull markets.

- Stocks with high dividends as a percentage of the stock’s price may be more volatile during outlier downturns.

- I believe investors should always consider the potential risk and reward of their investments to ensure they align with what they’re hoping to accomplish with their money.

- I believe it’s important to remain diversified and to maintain discipline when making investment decisions.

If you feel that you’d benefit from a second opinion of your investment strategy – answer a few questions to see if you may be a good fit for a complimentary consultation. As always, I wish you the best of luck, and hope to hear from you soon.

Best,

Michael Carbone

1 The S&P 500 is a composite of ~500 U.S. companies that are weighted (in the index) according to their market value. The index is essentially dividend agnostic, meaning that it’s indifferent when it comes to dividends. It owns companies that pay dividends and companies that do not, as well as companies that have cut or raised their dividend. The point is, there is no specific criteria related to dividends when it comes to companies within the index.

2 The Dividend Aristocrats and High Dividend Indices are composites derived from S&P 500 companies. The Dividend Aristocrats Index owns the companies with a strong track-record of paying/ increasing dividends.

3 The High Dividend Index owns the companies with the highest dividend yield i.e., the highest dividend as a percentage of the market value of the stock.

Past performance is not a guarantee of future results.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

Stocks offer long-term growth potential but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations and the potential loss of principal.

Stock dividends are not guaranteed and are subject to change or elimination at any point without notice.

Any opinions are those of Michael Carbone - not necessarily those of Raymond James. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that is accurate or complete. Expressions of opinion are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of strategy selected.