Investing in Retirement: Tips for Market Highs and Financial Stability

By: Michael Carbone, CFA, CFP®

Have you ever questioned whether you should be “doing something” with your money, after a long period of strong investment returns?

It's a common predicament for investors—especially those nearing retirement—to feel hesitant when markets hit all-time highs.

Yet despite such apprehensions, there are strategic ways to invest that can meet your growth needs, while also insulating you from potential market volatility.

Understanding Market Highs

A “market high” occurs when the collective value of stocks reaches a peak level that has not been previously surpassed. Markets are regularly making new highs. For example, since the turn of the millennium, the US stock market1 has reached new highs on ~380 separate trading days.

So, although the expression “new market high” may be often presented with a negative undertone, this phenomenon is certainly not out of the ordinary. New market highs are a common feature of an upward-trending economy and have recurred across financial history.

But that doesn’t mean investors should ignore market highs when managing their portfolios. Why? Because new highs sometimes occur alongside excessive market valuations and investor optimism—this has historically increased the odds of near-term volatility.

An Easier Way To Gauge Risk

I believe the concept of “mean-reversion” can be incredibly useful when setting expectations for future investment returns. This is particularly true for the average household, who is generally investing a portion of their assets to be spent decades in the future.

Mean-reversion, in the context of long-term investing, refers to the tendency of investment returns to revert to their long-term average over time. So, if investment returns have generally been above average for a period, mean reversion would suggest that subsequent returns may be lower, and vice versa.

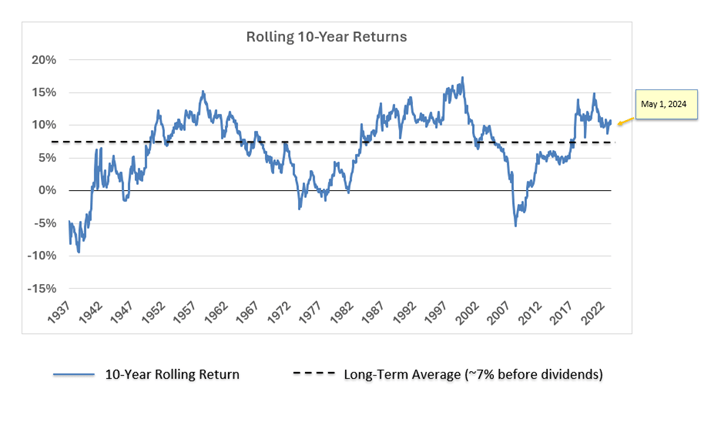

Consider the following chart of historical rolling 10-year returns for the S&P 500 Index (ignoring dividends):

If you consider where we are today from the perspective of mean-reversion, future investment returns may be in-line to slightly below their long-term averages.

Like Anything, Mean Reversion Has It’s Limitations

“In the short run, the market is a voting machine but in the long run it is a weighing machine.”

-Benjamin Graham.

Investment returns are typically difficult to predict over short time frames. Why? Because they can remain above (or below) their long-term average for many years. So, if you’re hoping to use the concept of mean reversion to avoid an imminent market move, you ought to consider a different indicator.

Instead, the concept of mean reversion can be incredibly helpful insight to have, when deciding how much of your wealth to allocate towards to riskier investments.

New Market Highs And Excessive Valuations And Optimism

As I write this:

- Markets have been reaching new highs

- Market valuations are considered by many to be a bit over extended, and

- Geopolitical risks have been generally rising, etc.

So, what does this mean for the average pre-retiree? If anything, I believe the average retiree should take this to mean that “uncertainty” has generally increased –and this may suggest that average future stock returns may be more likely to be lower than their long-term averages (i.e., ~9-10% with dividends).

But this doesn’t mean the average retiree should sell all of their stocks!!

Although expected future stock returns may be more likely to be lower than their long-term averages, there is still a very high probability that long-term average stock returns will be materially greater than bonds and inflation. And since most American retiree’s need to grow their money to keep up with their spending and inflation, it may be imprudent to sell all of your stock investments.

A strategy with better odds would be to invest your funds such that you have enough allocated to lower volatility investments, such as short-term bonds, C.D.s, etc. By doing so, you’re likely to be well-equipped to absorb any near-term volatility while also supporting your near-term spending needs. I’ve recently published a video explaining the three criteria to consider when allocating your personal wealth. Feel free to watch it here.

In Summary

While new market highs may stir up concerns of potential near-term volatility, remember that markets generally trend upward over time. It is not the altitude of the indices that should define your strategy, but rather how well your investment choices align with your needs for growth, liquidity, and your willingness to experience volatility. It's about ensuring your portfolio is positioned to weather volatility without derailing your retirement stability.

If you feel that you’d benefit from a complimentary consultation, click this link to answer a few questions. If you’re a good candidate for setting up a call it will bring you directly to my calendar to schedule some time.

I wish you the best of luck and hope to hear from you soon!

Michael

Important Disclosures

All investing involves risk and you may incur a profit or a loss. Past performance is not a guarantee of future results.1 The S&P 500 Index measures changes in stock market conditions based on the average performance of 500 widely held common stocks. It is a market-weighted index calculated on a total return basis with dividends reinvested. The S&P 500 represents approximately 75% of the investable US equity market. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

Any opinions are those of Michael Carbone not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change. This information is not intended as a solicitation or recommendation of any kind. Investments mentioned may not be suitable for all investors. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Diversification and asset allocation do not ensure a profit or protect against a loss.

Stocks offer long-term growth potential but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations and the potential loss of principal.

Investing in fixed income securities (aka “bonds”) involves certain risks such as market risk, if sold prior to maturity, and credit risk, especially if investing in “high yield bonds,” which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than their original cost upon redemption or maturity. Bond market values fluctuate inversely to changes in interest rates. In other words, if interest rates rise, after your purchase, you may receive less than your purchase price should you liquidate early, and vice versa. Bonds mature at face value and provide a fixed rate of return if held to maturity.

Brokered Certificates of Deposit (CDs) are “bond” instruments (aka “fixed income” securities). Most CDs pay interest semi-annually to your account. In most cases, early withdrawal may not be permitted; however, CDs can be liquidated in the secondary market subject to market conditions. Bond prices fluctuate inversely to changes in interest rates, such that you may receive more or less than you originally invested should you redeem early. In other words, if interest rates rise after your purchase, you may receive less than your purchase price should you liquidate early, and vice versa. Bonds provide a fixed rate of return if held to maturity. CDs are insured – subject to FDIC insurance limits. Brokered CDs do not automatically reinvest upon maturity. We must have a verbal discussion.

Securities offered through Raymond James Financial Services, Inc., member FINRA / SIPC. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. Eppolito Financial Strategies is not a registered broker/dealer and is independent of Raymond James Financial Services.