Developing a Stock Option Execution Strategy

By: Michael Carbone, CFA, CFP®

Employees are sometimes offered stock options as an incentive to participate in their company’s performance. This may be life changing for the employee if the stock price appreciates over time; however, these benefit packages can be complicated and risky. So, it may be wise to develop an execution strategy before making any big decisions. Key Elements of An Execution Strategy:

Investment Considerations

The investment component of an execution strategy is important. Once the options are exercised, the employee is fully exposed to the risk and volatility of the stock. This is especially risky because the company stock investment is undiversified – meaning the employee investor is exposed to specific risks of the company. These company-specific risks are out of the employee’s control.

So, the size of the resulting position after exercising options is an important consideration for the employee option holder. This is especially true if the employee plans to hold on to the stock. The employee should evaluate their exposure to the company stock in the context of their overall wealth. If the resulting company stock position represents a significant percentage of the employee’s total wealth, it may be advisable to consider implementing a hedge, or selling stock to achieve greater diversification.

Also, it’s very common for employees to experience behavioral biases when investing in company stock. These biases may lead employees to overlook potential issues, resulting in risky decisions. A qualified financial advisor may help the employee make more objective decisions.

Tax Considerations

The taxation of employee stock options can be complicated because there are often holding-period scenarios that will determine how profits are taxed. Generally, there are two sources of potential profit when an employee exercises an option, and then sells the stock at some later date:

- The spread (i.e., the bargain element) is the difference between the price an employee pays for the stock and the market value of the stock at time of exercise. This can be thought of as compensation from the employer as they’re able to purchase the stock at a discount to the market.

- Capital gains (investment profits) are realized if the stock price appreciates after exercising the option.

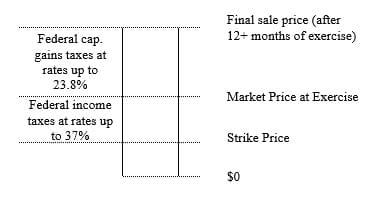

Taxation of Non-Qualified Stock Options (NSOs)

Generally, the spread earned on an NSO is taxable as ordinary income. So, the difference between the market price and strike price (note: the term strike price hasn’t been defined)at the time of exercise will pay taxes at the employee’s marginal tax rate for federal purposes. Federal income tax rates are progressive – rising with the employee’s salary – ranging from ~10-37%.

Should the employee decide to hold the stock for longer than 12-mo., any future gains will be taxed at long-term capital gains rates or 15 to 23.8% depending on the employee’s tax bracket.

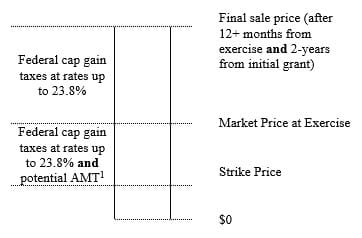

Taxation of Incentive Stock Options (ISOs)

ISOs are more complicated – generally, if the employee waits to sell the stock at least one year after exercising the option and two years from the initial grant date, the spread and any future capital gains will be taxed at capital gains rates. But there’s a catch.

The spread will be considered income for Alternative Minimum Tax (AMT)1 purposes. So, depending on the situation, the ISO holder may also be interested in reducing the spread when exercising their options. If the holder doesn’t meet the holding period requirements, it may be considered a disqualifying disposition resulting ordinary income taxes on any profits.

If the option holder believes the stock is undervalued by the market and anticipates holding the stock as a long-term investment, they may improve their after-tax returns by shifting potential future profits into the long-term capital gains category, effectively reducing their tax liability. This can be a risky strategy as stocks trading at low valuations relative to their peers may be unliked by investors for justified reasons.

Given the complexity of taxation for employee stock options, it’s important to understand the current and potential future tax implications before making decisions.

Personal Cash Flow Considerations

Employee stock options may require the employee to come up with large sums of cash to purchase the stock and pay taxes on profits. This is often overlooked as the options were given to the employee as compensation; however, the employee still has to purchase the stock! This may not be an issue if the option holder plans to exercise and simultaneously sell the stock, but if the employee plans to hold on to the stock, they’ll have to come up with the cash elsewhere.

This is also true for paying taxes in the year of exercise. Since the spread between market price and exercise price is taxed to the option holder as ordinary income (or may trigger AMT in the case of ISOs), the employee may owe substantial taxes in the year of exercise. If they plan to hold the stock, they may have major cash needs over the near term.

Also, if the stock price falls significantly after the employee exercises the option, it’s possible for the stock to lose more value than is owed in taxes. This was unfortunately the case for many ISO holders in the technology industry in the late 90’s. All scenarios must be considered.

Summary

When executing options, employee option holders should consider:

- Making investment decisions in the context of their total wealth.

- Behavioral biases that may be affecting their risk tolerance.

- The tax implications of different holding period scenarios.

- The personal cash flow requirements for purchasing the company’s stock and paying taxes on potential profits.

Please let me know if you’d like to have a conversation about your current situation. I’m happy to give you a second opinion about your employee stock options or other financial goals. I can be reached at Michael.carbone@raymondjames.com or 978-455-7799.

Please see important disclosures below.

Thanks for reading!

-Michael Carbone

1 The Alternative Minimum Tax (AMT) is a separate tax system that requires some taxpayers to calculate their tax liability twice—first, under ordinary income tax rules, then under the AMT—and pay whichever amount is highest. The AMT has fewer preferences and different exemptions and rates than the ordinary system.

Any opinions are those of Michael Carbone - not necessarily those of Raymond James. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that is accurate or complete. Expressions of opinion are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of the strategy selected.

Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Investment advisory services are offered through Raymond James Financial Advisors, Inc. Eppolito Financial Strategies, LLC is not a registered broker/dealer and is independent of Raymond James Financial Services.

Certified Financial Planner Board of Standards, Inc. owns the certification marks CFP® and CERTIFIED FINANCIAL PLANNER™ in the U.S.

Stocks offer long-term growth potential but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations and the potential loss of principal.

Past performance is not indicative of future results and there is no assurance that any investment strategy will be successful.

Financial and investment planning inherently involve potential tax and legal implications, with which we are generally familiar. We do not, however, practice as lawyers or CPAs and cannot give specific legal or tax advice. You should always consult with your tax advisor, or your attorney, when making complicated legal or tax decisions, however, we’re glad to work with your tax or legal professional to help you meet your financial goals. Raymond James financial advisors do not render advice on tax or legal matters.

Investing involves risk and you may incur a profit or loss regardless of the strategy selected. Options involve unique risks, tax consequences and commission charges and are not suitable for all investors. When appropriate, options should comprise a modest portion of an investor's portfolio. No statement within this document should be construed as a recommendation to buy or sell a security or to provide investment advice.