Tariff Watch: What’s Next?

Written by: Larry Eppolito, MBA, CFP®

Greetings!

As you may know, there’s been a bit of volatility lately, so it’s time to write. As things settled out at the beginning of the week, I gave myself a bit more time to write. I kept the top portion fairly brief for those who only want The Bottom Line. There is some good stuff underneath for Those Who Dare to Venture Forth.

Please keep in mind, I’ve view nothing from the point of view of a democrat or republican. I’m neither. I try to understand the issues on their own merits and consider them objectively.

I believe the following to be true.

The Bottom Line

Why Did the Market Drop About 5% on Back-to-Back Days Last Thursday and Friday?

Back-to-back drops like that usually happen when the market is caught by surprise. When a market reacts to unexpected news, it typically adjusts until it finds a new equilibrium that reflects the updated expectations.

So, what caused the surprise? The Trump Administration’s announcement of its tariff strategy, made after the market closed on Wednesday, was far more aggressive than what the markets had anticipated.

President Trump’s Stated Objectives:

- Reduce tariffs imposed by our trading partners on U.S. goods – ensuring fewer barriers for American exports abroad.

- Eliminate bilateral trade deficits – aiming for a dollar-for-dollar balance in trade – meaning, for example, if the U.S. imports $1 million in goods from Country A, that country should import an equal or greater value of U.S. goods in return.

- To add tariff taxes on consumers while simultaneously reducing taxes on wages across the board.

Many economists argue that higher tariffs – essentially a tax on U.S. consumers – could have several negative consequences. They may slow economic growth, create temporary (or in some cases prolonged) scarcity of certain goods, and ultimately lead to higher prices for consumers and slower economic growth in the U.S.

What About a Recession?

There’s been a lot of talk about a potential recession. Why? Because President Trump surprised the markets with tariffs that were significantly larger and broader than expected. If you read my post-election letter, “Tailwinds and Headwinds,” (November 26, 2024) you’ll remember that I described tariffs as a headwind to economic growth. This new policy shift only reinforces that concern.

Tariffs

Raymond James currently estimates the following:

- Base Case: Average tariffs charged on imports by the U.S. will rise from the current level of 5% to 22.5%*.

- This is more than double our previous estimate of a rise to 10%.

- Worst Case Scenario: Tariffs could rise to 31% -- or potentially even higher. (1)

*Note: Each country is taxed separately. In this case, “average tariffs” refers to the total tariffs collected on all imports to the U.S., divided by the total value of those imports.

Economic Growth and Inflation

At the beginning of the year, Raymond James projected:

- Economic growth to be 2.4%. We now expect growth to slow to 0%.

- Inflation to be 2.4%. That estimate has been revised upward to 5%. (1)

Risk of Recession

We believe there is a 50% chance the economy will enter a recession. If that happens, we expect it to be moderate in severity, rather than deep or prolonged. (1)

Why do we believe any downturn will be moderate? Here’s why:

- We started the year with a fairly strong economy,

- Consumers and businesses are not currently overburdened with debt,

- There are a number of offsetting tailwinds on the horizon, and

- Unemployment is starting from a low base.

Most important, as I’ve written many times, recessions are cleansing. But what do they cleanse? They remove excesses, correct supply and demand imbalances and eliminate bubbles caused by excess speculation. Right now, we don’t see large excesses, major imbalances, or a speculative bubble in sight.

Expected Market Decline from High Water Marks

As of the close of trading on Monday, April 7th, stocks have broadly declined by approximately 17% from the historical highs reached in mid-February 2025.

If the economy does fall into recession, history provides a useful guide for what to expect in terms of market declines (as measured from the high water marks):

- Moderate recession (GDP declines less than 2.5%): average market decline of -24%

- Severe recession (GDP declines more than 2.5%): average market decline of -37% (1)

So, should we fall into a recession, and should markets decline in line with historical averages, we may already be much of the way through the downturn – particularly if the recession proves moderate. Of course, conditions can always worsen, and markets can fall further. But this brings us to a common question:

“Larry, Why Not Step Aside Until the Coast Is Clear?”

As we’ve discussed many times, this approach has historically been a poor strategy. Why?

- Markets often bottom before the economy does. By the time headlines feel “safe” again, markets have typically already recovered and grown to much higher levels.

- Timing the exit is hard (it’s often too late). Timing the reentry is even harder. Many investors who step aside end up missing the sharpest part of the rebound.

- Although past performance cannot guarantee future results, staying invested in a diversified portfolio has consistently outperformed market timing over the long term – even during periods of volatility.

Why Larry, What Could Go Wrong with A little Time Out of the Market?

We’ve seen this movie before – most recently in March of 2020! On March 23, 2020, stocks bottomed after a 35% broad market pullback. Looking back, we now know that the bottom came early in the pandemic, about 9 months before widespread vaccinations and people emerging from their shelters. As I wrote on March 27, 2020, “I believe markets have either bottomed or will soon make a final bottom in the midst of the malaise.” In hindsight, the bottom had already been reached four days earlier! So, those who “sought shelter until the skies cleared” may have made a mistake with their long-term-oriented money.

Missing a few good days in the markets has historically had a huge impact on investment returns. Interestingly, the biggest up days often occur when the skies are still cloudy – when you least expect them.

The key point is, no one “rings a bell” when the market bottoms. It's rarely obvious that a new uptrend has started until well into the uptrend, as bad news starts to become “less bad” – gradually at first – before eventually turning good, often much later down the road. By the summer of 2020, we were hitting new historical highs!

What’s my point? The market's recovery was unexpected. The markets tend to look ahead to “better weather” coming down the road that we can’t clearly see – and moves up before we even realize it. Of course, other times, “more shoes drop” and markets experience another leg down – like we saw during the 2000-2002 downturn.

Professionals tend to think in terms of probabilities, not black and white outcomes.

From These Levels (as measured from the market close on 4/4/25), Raymond James expects the following potential outcomes for stocks by year end:

- Bull Case: Stocks broadly up 25% (20% probability),

- Base Case: Stocks broadly up 13% (50% probability).

- Bear Case: Stocks broadly down -10% (30% probability). (1)

Of course, market conditions can change quickly. Stocks may perform much better – or worse – than expected.

Confirmation Bias

No matter what happens, you’ll likely feel like you knew it all along. That’s called confirmation bias – and we all have it. I know I do. The key is recognizing it and trying to manage it, so it doesn’t cloud judgment or decision-making.

In summary:

- If President Trump sticks to his extreme long-held ideology of all trade deficits are bad, the economy may suffer – and we may have to weather a recession.

- He may also choose to moderate his stance in pursuit of a lasting legacy.

- Raymond James currently expects any recession to be moderate, though that outlook could shift quickly.

- If the recession is moderate, we may already be much of the way through the market downturn.

- If the recession is deep and prolonged, markets may fall further.

- Stocks can surprise both to the upside and downside – as many of you have seen in past cycles.

- The United States is by far the largest economy in the world and is very resilient.

- The best approach is to have a plan and stick to it. We revisit your allocation in every annual review.

- Those who properly adjust their allocation have “pre-planned” for times like these.

For Those Who Dare to Venture Forth

How Stubborn Will Trump Be on Tariffs?

I believe President Trump is using extreme tariffs as a starting point, giving himself room to pull back later and appear conciliatory. Why do I think that? Because many of the tariffs seem arbitrary rather than strategic.

Switzerland

- Take Switzerland, for example: they've been hit with a 31% – 32% tariff (the actual percentage is unclear, as the White House and the U.S. Trade Representative published different numbers) – despite having 0% tariffs on U.S. imports. That kind of mismatch suggests this may be more about posturing than policy precision. (2)

Reciprocal Tariffs Are Not Really Reciprocal

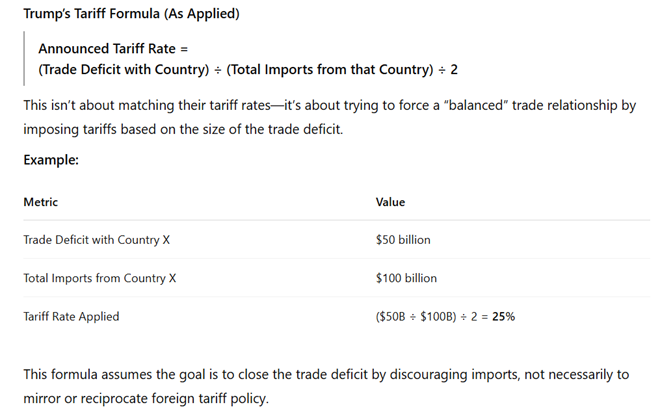

- Reciprocal tariffs means if you charge us 10% and we charge you 2%, we’re going to raise our tariffs to 10%. This is only fair. But that’s not what the Trump Administration means by “reciprocal tariffs.” (1)

Here is an example using the Trump Administration’s reciprocal tariffs formula:

So, even if your tariffs are 10%, we’re raising ours to 25% in this example. This shows the Administration is targeting trade deficits – not tariffs imposed by other countries.

President Trump’s Stated Goal

Although his goals have evolved over time, President Trump has recently stated that his goal is to achieve a zero trade deficit, meaning the U.S. would import and export goods at equal levels. He calls this “fair.” However, a trade deficit isn’t necessarily a good measure of a trading partner’s “fairness.”

Our Trade Deficit

In 2024, the U.S. imported roughly $3.1 trillion worth of goods while exporting about $2.0 trillion. This leaves us with a trade deficit of roughly $1.1 trillion. (3)

Why such a large deficit?

First and foremost, the U.S. is a very large economy. Our total economic output – measured as Gross Domestic Product (GDP) – was nearly $30T in 2024. This means, in addition to being a very resilient economy, we buy a lot of stuff – far more than our trading partners. So, it’s no surprise the U.S. has a large trade deficit – it’s a natural result of our purchasing power.

Here’s the top 10 economies by GDP in 2024.

- United States: ~$29.8T

- China: ~$18.5T

- Germany: ~$4.9T

- Japan: ~$4.4T

- India: ~$4.3T

- United Kingdom: ~$3.7T

- France: ~$3.3T

- Brazil: ~$2.4T

- Italy: ~$2.4T

- Canada: ~$2.4T

Source: International Monetary Fund

So, Why Do We Have a Trade Deficit?

- We’re big – very big.

- China’s economy is only 60% the size of ours – and no other country’s economy is even close to China’s.

- So, we buy a lot more stuff than other countries.

- The US dollar is generally relatively strong.

- A strong dollar means $1 buys a lot of other currencies.

- That makes imports cheaper, so we import more.

- We’re a Service-Based Economy

- The U.S. economy is dominated by services like finance, technology, and health care – not manufacturing.

- As a result, we buy a lot of manufactured goods from other countries.

- While we export a lot of services overseas, these service-oriented exports are largely not being considered by the Trump Administration in its trade deficit calculations.

- Our wages are high.

- Compared to most countries – especially developing economies – U.S. wages are much higher.

- This makes it more cost-effective to produce goods overseas.

- A trade deficit can be a sign of strength.

- It is a sign that consumers have money and are spending it.

- Tariff Differences May Play a Role

- Some countries impose higher tariffs on U.S. goods than we do on theirs.

- However, among developed countries, tariff differences are usually not a major factor in trade imbalances.

The Trump Administration’s Strategy to Achieve the Zero Deficit Goal

- President Trump's approach to reducing the trade deficit has centered on imposing tariffs intended to protect domestic industries and address perceived unfair trade practices.

- By charging US-based importers tariffs on imported goods, the administration aims to make imported products more expensive.

- The goal is to encourage consumers to buy American-made products and to incentivize companies to shift production back to the U.S. from overseas.

Potential Positives from High Tariffs

- Protecting Domestic Industries

- Tariffs raise the price of imported goods, making U.S.-made alternatives more competitive.

- This can help shield struggling sectors like steel, aluminum, or manufacturing from cheaper foreign competition.

- Encouraging Local Production

- When imports become more expensive, companies may invest more in domestic manufacturing.

- It can lead to reshoring jobs, increasing production and employment at home.

- National Security Benefits

- Protecting key industries like semiconductors, energy, or defense manufacturing helps ensure those capabilities remain in the U.S.

- This can reduce reliance on foreign supply chains in critical areas.

- Bargaining Power in Trade Negotiations

- Tariffs can be used as leverage to push other countries to lower their own trade barriers or address unfair practices (like IP theft or currency manipulation).

- Potential Revenue Boost

- Tariffs are, essentially, a tax on consumers and can generate money for the government – billions in revenue – which can offset spending or reduce deficits.

- Reducing the Trade Deficit (in theory)

- Higher prices on imports could reduce demand for foreign goods, narrowing the trade gap (though the real-world effect has often been limited or offset).

So, what’s the problem?!

Potential Negatives from High Tariffs

- Higher Prices for Consumers

- Tariffs make imported goods more expensive—and those costs often get passed on to U.S. buyers.

- That means higher prices on everything from electronics to clothing to groceries.

- Retaliation from Trading Partners

- Countries often respond with retaliatory tariffs, targeting U.S. exports (like agriculture, autos, or machinery).

- This can hurt American farmers and manufacturers whose business relies fully or partially on exports.

- Our Export Industry is Currently $2T

- Exports account for about 7% of our GDP.

- Developed countries like the U.S. typically export higher-value goods, such as technology and high-end equipment, rather than low-value items like sneakers.

- S. exporters may lose business due to reciprocal actions from their trading partners.

- S. entrepreneurs may be discouraged from starting businesses that rely, in part, on exports.

- Supply Chain Disruptions

- Many U.S. companies rely on global supply chains, sourcing parts or materials from abroad.

- Tariffs can raise production costs or create delays, especially in industries like technology and automotive.

- Less Global Competitiveness

- S. companies may face higher input costs, making it harder to compete globally.

- If the domestic industry becomes too protected, it may lose the incentive to innovate or cut costs.

- Tariffs May Reduce Expansion Plans

- The uncertainty and confusion surrounding the tariff policy are causing many companies to pause or scale back their plans for U.S. capital expenditures on manufacturing. When visibility is low, businesses often hold off on major investments.

- Slower Economic Growth

- If tariffs dampen trade or investment, the broader economy may slow down.

- In extreme cases, widespread tariffs can contribute to a global recession, especially if many countries follow suit.

- Extreme tariffs can lead to chronically slow economic growth, contributing to a larger federal budget deficit and fewer opportunities for U.S. workers.

- Strained International Relations

- Aggressive tariff policies can damage relationships with allies and key trading partners.

- They may also lead to reduced cooperation on other important global issues like security, climate, and diplomacy.

- Growing anti-American sentiment may lead many consumers around the world to stop buying American goods altogether.

Because a trading partnership often involves substantial investments in supply chains and infrastructure, these relationships are built on trust and mutual cooperation. When trust is undermined, it can have long-lasting negative effects on both sides.

What’s the Tariff Endgame?

We believe there are three potential paths ahead:

- Negotiation and Reduction of Tariffs: Trump could begin cutting deals, leading to reduced tariffs.

- Legal or Congressional Block: Courts or Congress could intervene and block the tariffs.

- Historic Realignment of Global Trade: Trump could maintain his stance, resulting in a major shift in global trade dynamics, if Congress and the courts allow. (4)

We believe:

- The market is hoping for option 1 and option 2, with concerns over the possibility of a historic realignment (option 3).

- Legal challenges could arise, particularly from the Trade Act of 1974, which limits the president’s emergency powers.

- Although the US Constitution grants Congress the authority to levy taxes, including tariffs, Congress has passed laws allowing the President to impose tariffs for national security reasons unilaterally. Congress can potentially vote to take back this authority.

- While Congress has limited influence at the moment, pressure could build if economic impacts worsen. (4)

Why Might President Trump Back Off His Stated Goals?

Some factors are measurable and can be estimated. Others – intangible factors – are not easily measured or proven, but they can still carry significant weight. These include:

- President Trump’s desire to be remembered for a strong economy.

- A prolonged recession would damage that legacy.

- The importance of the 2027 midterm elections.

- A weakened economy could hurt his party’s chances, which in turn could reduce his influence.

- The upcoming 250th anniversary of the United States.

- The celebration kicks off on July 4th, 2025, and runs through July 4th, 2026. The global spotlight will be on the U.S.—and President Trump is someone who values being at the center of attention.

These intangible pressures may motivate him to soften his approach or pivot away from the more extreme aspects of his trade strategy.

Winners and Losers

- Winners: Mexico and Canada will currently pay no tariffs on all USMCA* compliant goods. This is in line with the original agreement. Non-USMCA compliant goods are taxed at 25%, but if there is progress on fentanyl and immigration they could go to 12%.

- *United States-Mexico-Canada Agreement (USMCA, 7/1/2020)

- Losers: China, Europe and Vietnam are all facing stiff tariffs. (1)

Keep your friends close and your enemies closer. (Sun Tzu, Chinese military strategist, c. 5th century B.C.)

China

The Trump Administration’s main focus has been China. This seems to be where President Trump’s tariff ideology originated. Many experts agree that China’s trade practices need to be addressed – they arguably don’t trade fairly. But trade with China has also made the two nations economically co-dependent, and that’s important to keep in mind. China doesn’t have to be our enemy. Why?

In 2024:

- The US exported $144B worth of goods to China.

- The US imported $439B worth of goods from China.

- The resulting trade deficit was $295B. (5)

Non-Tariff Barriers

But again, a trade deficit doesn’t necessarily mean the other side is exploiting us. In this case, however, many experts argue that, in addition to imposing higher tariffs on U.S. goods, China uses a wide range of non-tariff barriers – including licensing and regulatory restrictions, foreign investment limitations, and import quotas. They have also failed to fully address long-standing U.S. concerns around forced technology transfers and weak intellectual property protections.

China remains deeply engaged – and reliant – on the global economy. That’s a good thing. Economic interdependence lowers the risk of deeper conflict. It means we may sometimes be trade adversaries, but we can still be partners. We both benefit from a functioning global system. Relationships matter.

By the way, China is not as financially powerful as many believe (and seem to fear). But that’s beyond the scope of this letter.

Russia – A Contrast

Russia has decided to step away from the global economic community. They trade very little with democratic nations. As a result, the U.S. and Russia are not economically dependent on each other—and that lack of mutual interest leaves little incentive for cooperation. That potentially makes Russia more geopolitically dangerous.

In 2024:

- Russia’s GDP was roughly $1T and is heavily reliant on energy production.

- Its population is about 40% of the size of the U.S., but its economy is only about 7% as large. Think about that. (3)

Russia is just one example of how democracies can outperform authoritarian regimes in terms of growth, development and standards of living.

Emerging Markets Have Traditionally Been Given Leeway

Developed countries have historically allowed emerging markets to use tariffs to protect their growing industries and raise living standards. The idea was that helping them develop now would create future consumers of U.S. goods. But under the current tariff environment, even emerging economies are feeling the pain.

In summary, I believe:

- The U.S. trade deficit largely reflects the size, strength, and structure of our economy – not exploitation.

- While tariffs can offer some protection to domestic industries and serve as leverage in trade negotiations, they also carry significant risks, including:

- Higher consumer prices,

- Supply chain disruptions,

- Retaliation from trading partners,

- Harm to our export industry,

- A headwind to economic growth – lowering living standards and reducing opportunity,

- Strained relationships with trading partners.

- The markets are hoping President Trump is using tariffs as a bargaining tool not a long-term policy.

- Although sending mixed signals, the Trump Administration – including Trump himself – is currently discussing negotiating with our trading partners.

- It’s important to keep our friends close – and our enemies closer.

People Often Mistake the Temporary for the Permanent

Over the years, I’ve noticed that people tend to believe that whatever is happening now will continue indefinitely. But history tells a different story. Even during the most difficult times, “long” has never meant “forever.”

“For myself I am an optimist – it does not seem to be much use to be anything else.” (Winston Churchill)

I believe the future remains bright for the United States. But we may need to push through a period of near-term turbulence to get there.

Best wishes,

Larry

4/9/2025

P.S. Please feel free to send this along to those who may benefit.

Important disclosures

Eppolito, Carbone &Co., LLC. is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through Raymond James Financial Services Advisors, Inc.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Main Sources:

- Raymond James, Markets on the Clock, Larry Adam, CIO, Monthly Market Update Presentation, April 7, 2025

- Hamilton Lane Weekly Insight, Blaine Rollins, Weekly Research Briefing: “Madagascar” 4/8/2025

- International Monetary Fund

- Raymond James, Washington Policy, Ed Mills et al. What’s the Tariff Endgame? April 6, 2025

- United States Trade Representative (.gov)

Other Sources:

- Raymond James Washington Policy Weekly Wrap, Ed Mills et al.

- Raymond James Weekly Investment Strategy

- Raymond James Weekly Institutional Equity Strategy

- Raymond James Weekly Economic Release

- Raymond James Daily Morning Brew

- The Wall Street Journal

- CNBC Professional

- Bloomberg News

- Financial Advisor Magazine

- New York Times

- The Boston Globe

Important Disclosures

Any opinions are those of Larry Eppolito and Michael Carbone not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change. This information is not intended as a solicitation or recommendation of any kind. Investments mentioned may not be suitable for all investors. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Diversification and asset allocation do not ensure a profit or protect against a loss.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Stocks offer long-term growth potential but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations and the potential loss of principal.

Investing in fixed income securities (bonds) involves certain risks such as market risk, if sold prior to maturity, and credit risk, especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond prices fluctuate inversely to changes in interest rates. In other words, if interest rates rise, after your purchase, you may receive less than your purchase price should you liquidate early. Bonds provide a fixed rate of return if held to maturity.

Other Important disclosures

Any information provided in this e-mail has been prepared from sources believed to be reliable but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in e-mail. This e-mail is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.

Opt-out

If you wish to opt-out of my group letters, please respond to this email or call me.